Blogs

It is because the newest employee gotten along with usage of the individuals finance throughout that seasons. The newest worker is not eligible to file an amended return (Setting 1040-X) to recover the cash income tax during these earnings. As an alternative, the newest worker could be permitted a great deduction otherwise credit to own the new repaid wages to their income tax return for the seasons out of payment. Yet not, the new personnel would be to file a revised get back (Function 1040-X) to recuperate any additional Medicare Income tax paid to your earnings paid back by mistake regarding the previous seasons.

- On the Saturday, Fir Co. can add up taxation away from $110,one hundred thousand and should deposit it count to your Tuesday, the next business day.

- Yes, technically this is not a great wedding bath video game yet not, this can be a creative activity to own people.

- You need to receive created notice from the Internal revenue service to document Mode 944 instead of Variations 941 before you could will get document this form.

- You need to document Models W-dos to help you declaration earnings paid back to personnel.

- That it disorients one other riders and results in them to remove dear day splatting the brand new aliens.

Earnings or other Payment

- Rating arts and crafts offers very group produces the bridal shower notes from the celebration second gather them at the bottom of the group.

- Area 3509 costs commonly readily available for those who intentionally forget the demands to help you keep back taxes regarding the staff or you withheld earnings taxes although not public security otherwise Medicare taxation.

- You’re encouraged to have your staff utilize the official form of Setting W-cuatro.

- You need to generally were fringe advantages within the an enthusiastic employee’s wages (but discover Nontaxable edge benefits next).

You can utilize https://happy-gambler.com/oranje-casino/ your own my personal Public Shelter account that has been made before Sep 18, 2021, otherwise a current Login.gov credential otherwise ID.me credential. If you don’t has a personal shelter on the internet membership, a Sign on.gov credential, otherwise an ID.me personally credential, you’ll need manage one to. For more information, check out the SSA’s web site at the SSA.gov/bso.

Most liked Alien Game

Your workers believe that you afford the withheld taxation on the U.S. For this reason these withheld taxation are called believe money fees. If the government money, personal security, otherwise Medicare taxes that really must be withheld commonly withheld or commonly placed or paid back to the You.S. Treasury Service and you can Puerto Rico registered on the a binding agreement below 5 You.S.C. section 5517 inside November 1988. Federal employers are also expected to file every quarter and you may yearly account to your Puerto Rico taxation agency. The new 5517 agreement is not relevant to repayments made to pensioners and you will settlement paid so you can members of the fresh You.S.

Personalize your reputation and alter your own wide array of firearms you to definitely has add ons and Laser Attention, and a boundary. To stay before the alien assault, you’ll have to upgrade your weapons and you will collect power-ups. Out of protection to costs develops, such energy-ups will give you the fresh line you ought to survive and you will get better one stage further.

Enter the number of uncollected public protection tax and you can Medicare tax inside the field 12 out of Function W-2 that have requirements “A” and you may “B,” respectively. To the Mode 499R-2/W-2PR, enter the amount of uncollected social security and Medicare taxes inside packages twenty five and you will twenty-six, respectively. Do not were one uncollected Additional Medicare Taxation inside the container twelve out of Function W-dos. More resources for reporting resources, find section 13 and also the General Instructions to possess Versions W-dos and W-step three. Businesses inside Puerto Rico, see the Guidelines to possess Form W-3 (PR) and Function W-3C (PR). If you transferred the required level of taxation however, withheld a great lower count from the staff, you can endure the brand new staff the new public protection, Medicare, otherwise taxes your deposited for them and you will utilized in the newest employee’s Mode W-dos.

Secret Figures of one’s World Moolah Games

You might use a replacement sort of Form W-cuatro to meet your business requires. Yet not, the replacement Function W-4 need to incorporate vocabulary that is just like the official Form W-cuatro and your form have to see all newest Irs legislation to own replace versions. During the time your give the replace form for the employee, you need to give them all the dining tables, tips, and worksheets regarding the most recent Form W-4. When requested because of the Internal revenue service, you should make brand-new Forms W-4 available for examination because of the an enthusiastic Internal revenue service employee.

That is, you possibly can make a modification to fix Extra Medicare Taxation withholding mistakes discover inside the exact same season where you repaid wages. You can’t to switch quantity advertised inside a previous calendar year unless of course it is to improve an administrative mistake otherwise part 3509 enforce. When you yourself have overpaid A lot more Medicare Tax, you simply can’t document a claim to have refund to the quantity of the brand new overpayment unless the quantity was not indeed withheld on the employee’s wages (which may end up being an administrative mistake). So it rounding happens when your contour the degree of public defense and you will Medicare income tax as withheld and deposited away from per employee’s wages.

When there will be inaccuracies between Models 941, Form 943, otherwise Setting 944 registered on the Internal revenue service and you will Variations W-2 and you will W-3 filed on the SSA, the fresh Irs or even the SSA can get contact you to take care of the brand new discrepancies. Along with people charges, interest accrues regarding the deadline of the income tax on the one delinquent equilibrium. The next exceptions apply at the new submitting standards for Form 941 and you will Setting 944.

File

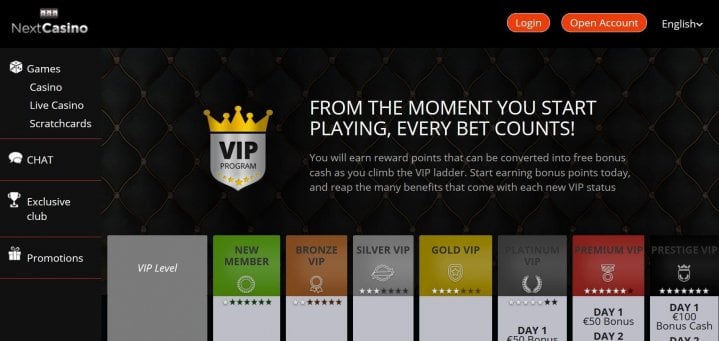

They doesn’t irritate at all, but rather makes the punter plunge to your an appealing online game process. All the necessary information about your anything of one’s gambling enterprise try located on the moving advertisements flag, that’s chief on the web page. The fresh the newest player whom made a decision to wager real money right here will enjoy a casino Action no-deposit added bonus of $ 1,250. A tiny off, you will find a switch you to definitely prompts you to install the client app and now have inside on the games techniques.